YOUR NEW SOURCE OF TRUTH

Have Confidence in Actionable Data

We answer key questions on companies to help investors make smarter decisions and help companies to increase share, sales, and customers

90+

Reports2M

E-Receipt Panelists20K

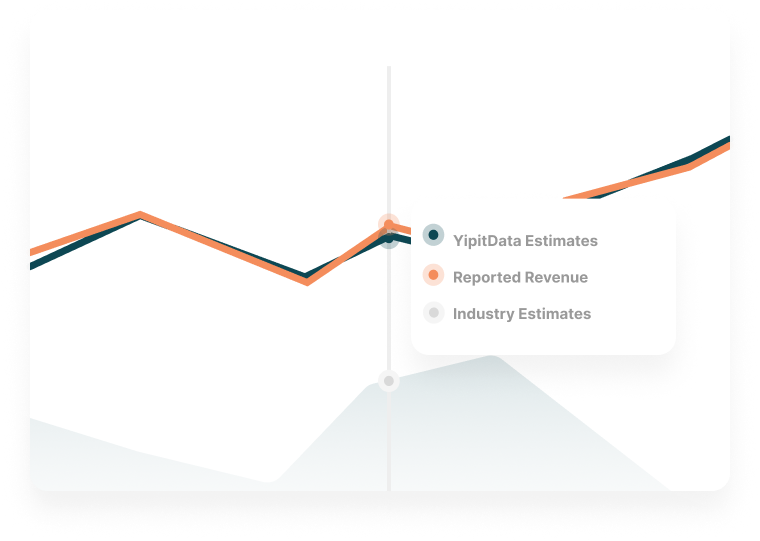

BrandsUnmatched Accuracy

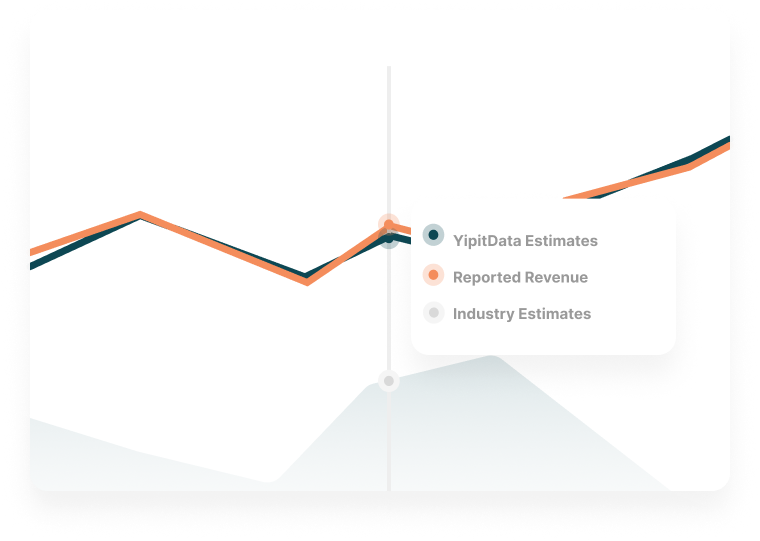

10 years of experience combined with large sample sizes create scale for unmatched accuracy

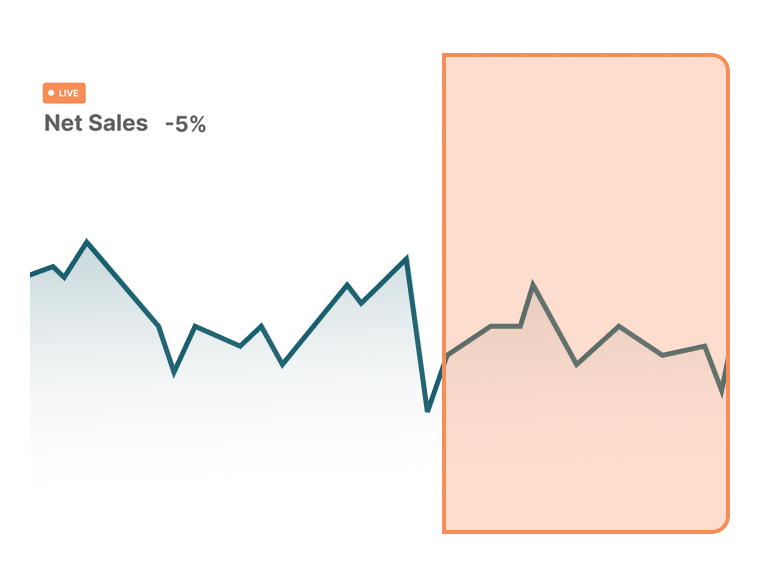

Near Real-Time data delivery

Alternative data delivered as fast as possible

Transparent methodologies and sample sizes

90+

Reports2M

E-Receipt Panelists20K

BrandsScore card of accuracy and sample size available

YOUR SINGLE SOURCE OF TRUTH

The YipitData Difference

We identify, collect, clean, and analyze the best data in the world to deliver accurate answers to your questions, so you can focus on decisions

![]() indicates proprietary data source or proprietary methodology

indicates proprietary data source or proprietary methodology

RECEIPT DATA

Item and category level data for retailers and brands

CARD DATA

Full order level retailer coverage supported by robust sample

WEB DATA

Cutting-edge web data collected from numerous sites across industries

PUBLIC EARNINGS

Results calibrated to company-reported earnings through transparent self-audits

40+ Datasets

Ongoing acquisition of diverse datasets for maximum client value

Accurate Data You Can Trust

In Depth Views on Business Performance

Actionable data on the companies that matter to you

Gain transparency into the building blocks of company performance with access to accurate timely data in the format that best suits your process.

See Our Coverage

Research & Analysis

Get detailed analysis from top-line to in-depth business performance.

Dashboards

View KPIs and granular datasets through our platform of dashboards.

Data Feeds

Gain access to the underlying data feeds that power YipitData.

Paid with Visa CC

Item(s) discount

-$63.28Subtotal

$305.74Shipping

FREESales Tax

$22.93Order Total

$328.67Fuel revenue growth with data driven decisions

Accurate market measurement with the ability

to diagnose the consumer behaviors that

drive performance.

Market Trends

Market share breakdowns by in-store & online, sub-category, region, or demographic.

Consumer Behavior

Consumer behavior diagnostics including cross-shopping & leakage, customer acquisition & frequency, and AOV.

Product Category Analysis

Category & sub-category analysis for custom categorizations, competitive pricing, discounting, and assortment analysis.

Largest & Most Trusted Data Partner

We provide funds and companies with the data they need to make decisions

2000+

Companies Covered

500+

Customers

Carlyle Group Leads 475M Series E

YipitData announced a Series E funding round, led by global investment firm Carlyle (NASDAQ: CG). YipitData has gained rapid momentum among institutional investors and corporations with its highly accurate, detailed research